Portfolio Rationalization

Portfolio Rationalization is the process of analyzing the assets or investments in a company's IT portfolio

to determine their business value, performance, and impact. These three measures provide the basis for the rationalization analysis. The analysis ranks the

various investments and identifies opportunities to strengthen the portfolio by adjusting the investments.

Zifian's Portfolio Rationalization solution is a combination of IT analysts, risk management professionals,

and business managers who use Zifian's proprietary methodologies and analysis tools.

Portfolio Rationalization is carried out in a series of steps starting with a snapshot of the investments

and culminating with recommendations for rationalization.

Portfolio Rationalization Benefits

Benefits of Portfolio Rationalization include:

- Provides a detailed understanding of each IT investment in the portfolio.

- Performs a thorough risk assessment for each IT investment.

- Analyzes the alignment between each IT investment and the organization's business objectives.

- Identifies investments that are not aligned with the business objectives.

- Identifies groups of investments that can benefit through economies of scale.

- Determines gaps in the portfolio where additional investments may benefit the organization.

- Highlights investments that require additional resources.

- Formalizes detailed plan of action.

The Portfolio Rationalization Process

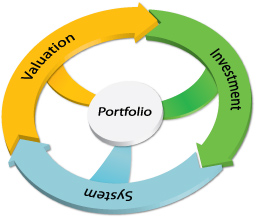

Portfolio Rationalization is divided into four main phases.

Valuation:

We review your portfolio and prepare a set of technical guidelines and data to provide a means to value each asset. The assets are valued and ranked with respect to each other.

Investment Analysis:

In this phase, we examine each asset, determine the asset category values, and compute the business value.

System:

The System Analysis phase of portfolio rationalization examines groupings or clusters of investments. This phase identifies groups of assets with similar properties in order to facilitate the rapid identification of high-performing investments as well as problem areas.

Portfolio:

In the Portfolio Analysis phase, we focus on analyzing the portfolio as a whole. This is distinct from the System Analysis phase because although the System Analysis phase examines groups of investments, it does not analyze the portfolio as a whole. The Portfolio Analysis phase represents the culmination of portfolio rationalization and results in specific recommendations for investment action.